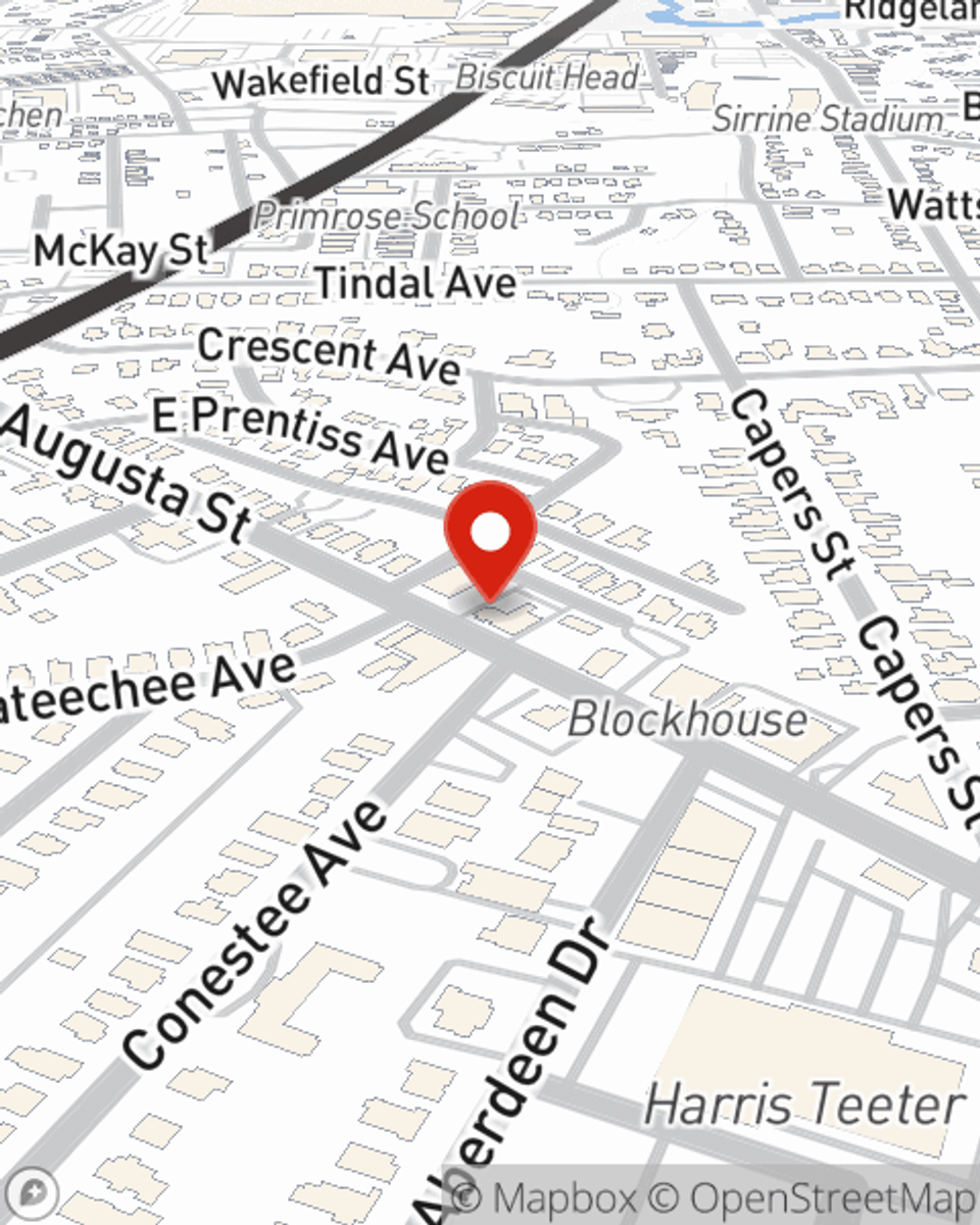

Business Insurance in and around Greenville

One of the top small business insurance companies in Greenville, and beyond.

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

You may be feeling like there is so much to do with running your small business and that you have to handle it all by yourself. State Farm agent Joe Bond, a fellow business owner, recognizes the responsibility on your shoulders and is here to help you put together a policy that's right for your needs.

One of the top small business insurance companies in Greenville, and beyond.

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

State Farm has been helping small businesses grow since 1935. Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a psychologist or a plumber or you own a pet store or an advertising agency. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Joe Bond. Joe Bond is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to familiarize yourself about your small business insurance options

It's time to contact State Farm agent Joe Bond. You'll quickly find out why State Farm is one of the leading providers of small business insurance.

Simple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Joe Bond

State Farm® Insurance AgentSimple Insights®

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.